What We Feel: The market needs your solution now. You can’t understand why it is taking so long to get investors, win customers or attract employees. Doesn’t everyone see what you see?

R. Buckminster Fuller, architect and inventor, once said: “I just invent, then I wait until Man comes around to needing what I’ve invented.” What a pure, insightful, and powerful perspective. Also a great way to run out of energy and money.

As entrepreneurs, we believe our solution is unique. Otherwise, we would not leave the stability and sanity of the real world to enter this parallel universe. Once we make the leap, we are convinced that our idea is unique, necessary and the missing solution in an underserved market. Our perspective is, “I’m surprised that the market isn’t clamoring for my solution now! Once we get it out there, we will be off to the races.” While this perspective can be exciting and invigorating (there’s that passion taking over again), it can also create misalignment of people, financial resources and expectations.

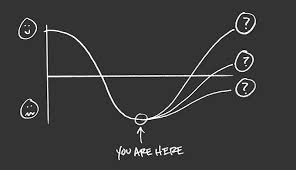

Uniqueness is both a blessing and a curse. When an idea or product is unique, it is new to the market. This may be what makes it sell, but it is also what makes the market slow to comprehend and adopt your innovation. So, one of the perspectives we must develop is the ability to clearly judge how ready the market is for your solution. Understanding what inning you are in is critical to:

• establishing the right pace for your company

• setting expectations for your team and other constituents

• aligning capital and other resources.

For example, knowing how long it will take for the market to accept your idea is critical to aligning the early employees of the company. Communicating that you are six months away from revenue in a market that really requires eighteen months sets bad expectations for your team, vendors, and especially, investors. Six months in, there will be disappointment from all sides. For example, employees will get frustrated and worn out when you pass the six-month mark and you can’t off er the raise your promised them for sweating the hard, early months.

This is also important when it comes to investment capital. The amount of capital you need for market viability, and the point in time that you raise it, are largely based on what inning you are in:

At IncentOne, in the mid-2000s, it seemed like a no-brainer that health organizations would adopt incentives for healthy behavior. What we failed to realize was how old school the health industry was. They already thought they had incentives in the form of co-pays in health plan designs. Because we thought we were in the fifth inning when we were in the second inning, we misaligned our capital needs and underestimated how long it would take to get to market.

Today, people say, “You guys were way ahead of your time.” In entrepreneur speak, that means two things: that it was visionary, but you should have recognized the inning you were in and aligned capital needs accordingly.

There are many factors that go into this determination: the nature of the industry, established players, competitive solutions, pricing models, market influences, nature of the disruption, and the list goes on. Plan accordingly.

Join our community here to receive daily The Lonely Entrepreneur Blog that helps with the struggle and empowers you to thrive.

[tell-a-friend id=”1″ title=”Tell a friend”]

[tell-a-friend id=”1″ title=”Tell a friend”]